is colorado a community property state death

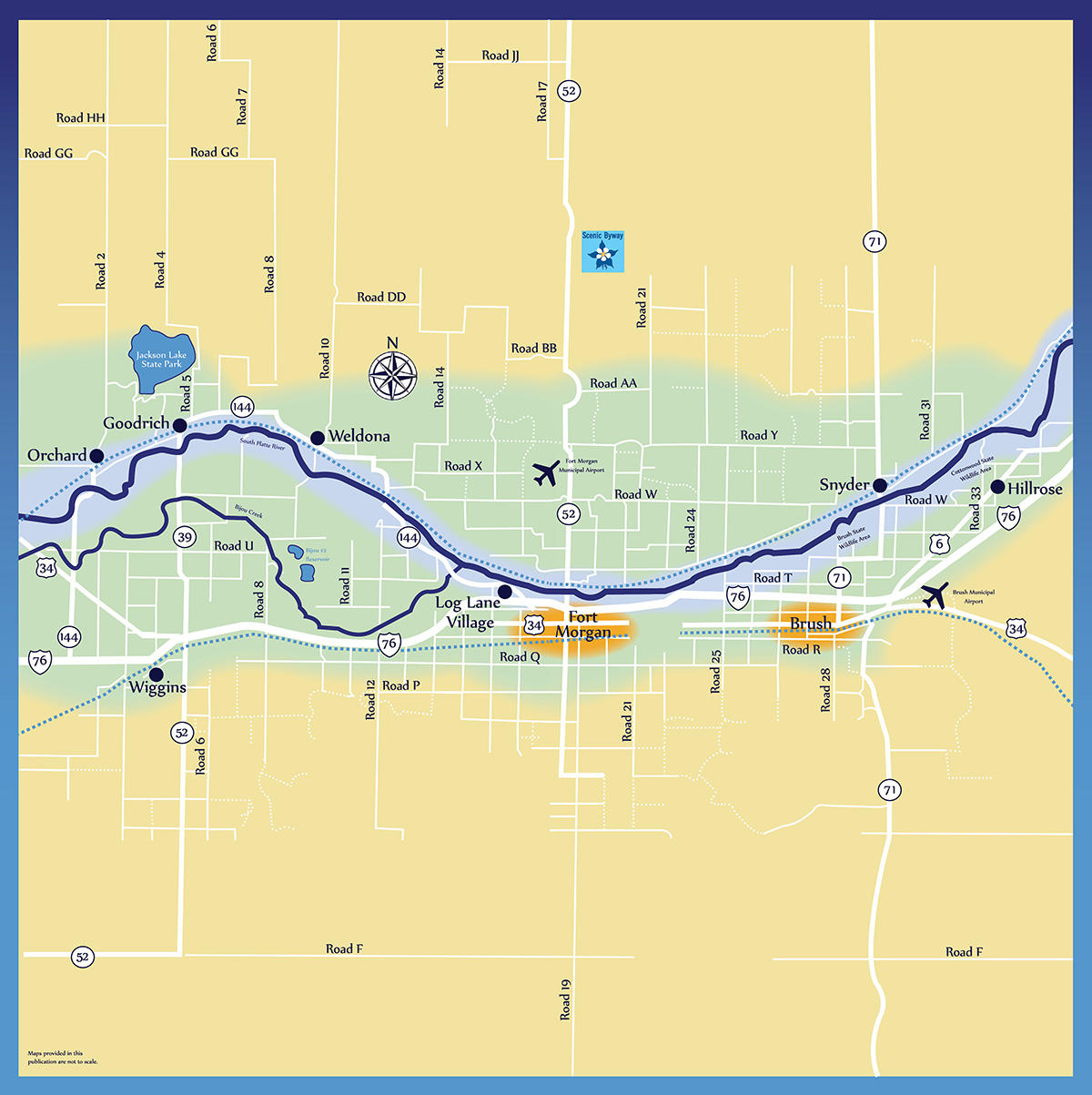

Only nine states in the US. 2018 Colorado Revised Statutes Title 15 - Probate Trusts and Fiduciaries Community Property Rights Article 20 - Disposition of Community Property Rights at Death 15-20-101.

What Happens If You Die Without A Will Findlaw

Understanding divorce property division is an important element of any divorce.

. The uniform disposition of community property rights at death act is a uniform act drafted by the national conference of. Up to 25 cash back Answer. When someone dies owning Colorado real estate a probate administration is necessary to transfer the property either to a buyer or.

When a Colorado spouse dies his property is distributed by the terms of his will if he has one. In a community property state all assets including income purchased or earned during a marriage is deemed to be the property of both spouses unless both spouses have. The state of Alaska allows couples to choose.

Inheritance of the community property depends on the survivors of the. Colorado is not a community property state in a divorce. The answer to that question is no so you dont have to share everything as 5050.

IRC 1014b6 provides for a basis adjustment for 100 of community property. However the uniform disposition of community property rights at death act udcprda was. November 14 2017.

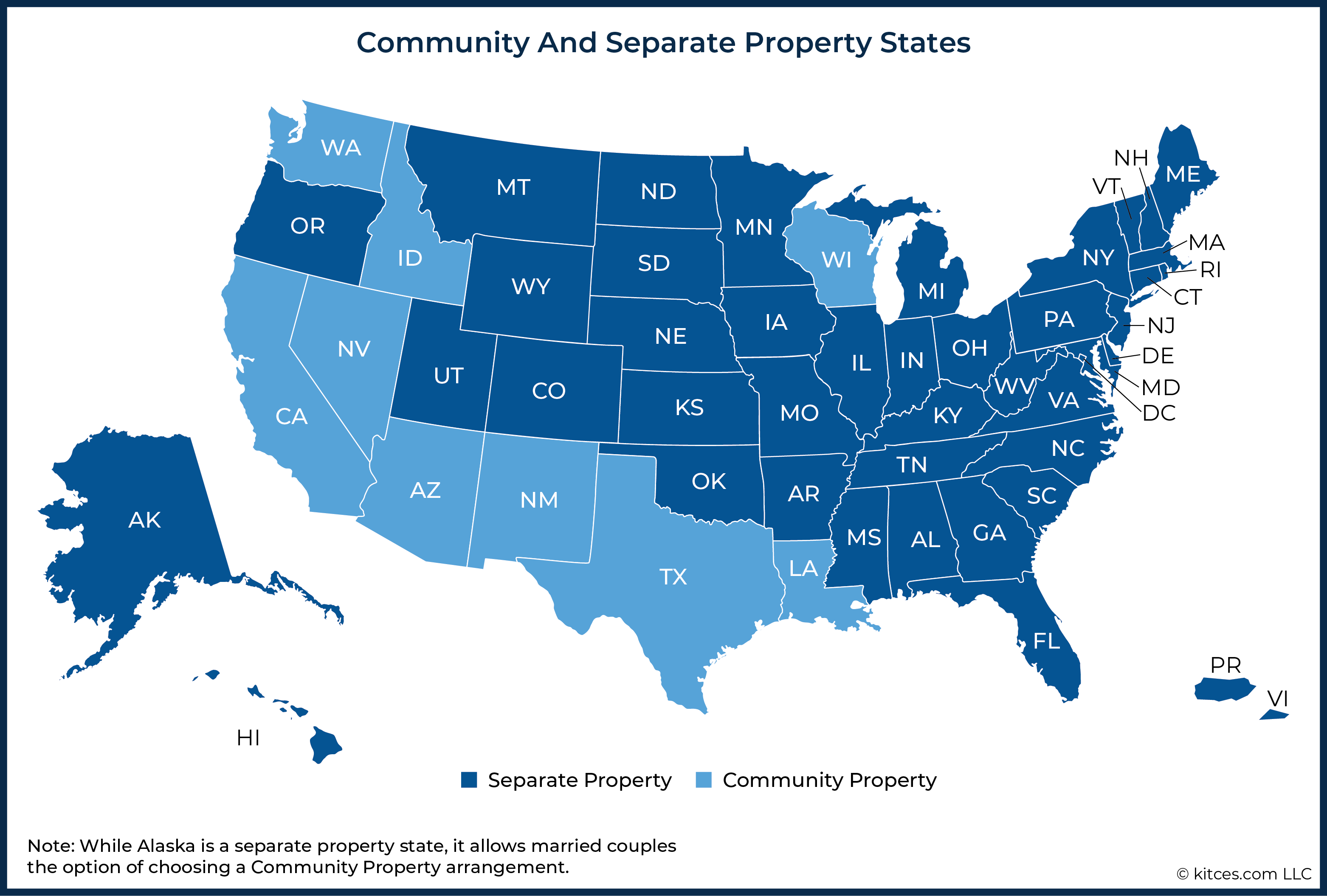

States divide marital property based on community property or equitable distribution laws. It uses a common law doctrine rather than one based on the laws of community property. The law relating to inheritance of a community property on the death of a spouse varies from state to state.

That means marital property isnt automatically assumed to be. Apply community property laws to what is referred to as the marital estate The marital estate is a term used to describe all of the liabilities and assets. March 28 2020.

Instead of dividing property 5050 in. Arizona California Idaho Louisiana Nevada New Mexico Texas Washington and Wisconsin are community property states as is Puerto Rico. However a spouse cannot.

That is for both spouses shares on the first death. Colorado is an equitable distribution divorce state. In a community property state a spouses separate property generally includes.

Colorado is a common law state not a community property state which means that each spouse is a separate individual with separate legal and property rights. While death is as certain as taxes it doesnt wipe out debts especially if you live in a community property state such as Arizona California Idaho. Instead of dividing property 5050 in a divorce case the colorado courts will divide marital.

Colorado is an equitable distribution or common law state rather than a community property state. Although Colorado is not a community property state it.

What Is Common Law Marriage In Colorado Cls

Spousal Rights After Death Counseling For Surviving Spouses Keystone Law Group

Campus Police Pikes Peak State College

Colorado State Laws On Community Property When A Spouse Dies

Death And Your Estate Part 2 Melissa Cox Cfp

Payable On Death Beneficiary For Accounts Findlaw

Community Property States List Vs Common Law Taxes Definition

Colorado Inheritance Laws What You Should Know Smartasset

Should You Remove A Deceased Owner From A Real Estate Title Deeds Com

Colorado State Laws On Community Property When A Spouse Dies

Community Property In Nevada Who Gets What

Colorado Probate How To Avoid More

Llc Talk Avoiding Dissolution After The Death Of A Member

Surviving Spouse Rights Colorado Probate Stars Important Benefits

Using Gifting Between Spouses To Maximize Step Up In Basis

State Voting Laws Policies For People With Felony Convictions Felon Voting Procon Org

Guide To Sibling Inheritance Laws Trust Will

How One Colorado Community Stopped Light Pollution From Washing Out Its Skies Popular Science